Customer Relationship Management (CRM) software solution is one of the most important parts of a business. It supports managing customer records, streamlining processes, increasing sales, and improving customer experience. While accounting software is equally important, it keeps financial records accurate, compliant, and audit-ready. Most businesses — even the smallest — run on both.

But the real game changes when many businesses start integrating CRM and accounting software. As the separate systems for sales and finance often result in making big decisions with a half-picture. The integration not just simplifies operations but also exemplifies productivity. CRM accounting integration is like merging the capabilities or filling the limitations for the benefit of the organization.

In this blog, we will see why CRM accounting integration matters for fast-growing businesses.

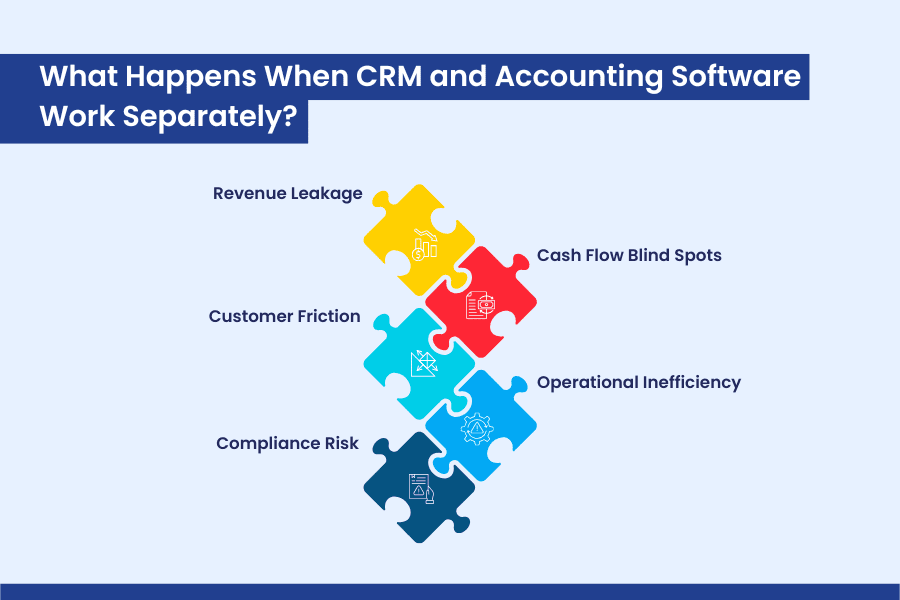

What Happens When CRM and Accounting Software Work Separately?

It’s very common to use different systems for different tasks. Each team gets tools designed for their function. But today, when AI and automation are raising expectations, managing large volumes of data requires smart practice. Then integration is considered the most sustainable practice. We have listed the following challenges that show up in fast organizations:

1. Revenue Leakage

Deals move fast in CRM, but if finance doesn’t see them instantly, invoices are delayed or overlooked. In a growth stage, even small delays translate into serious revenue slippage.

2. Cash Flow Blind Spots

Leadership can’t get real-time payment status when data sits in two systems. Forecasts that look promising one week can unravel the next, leaving teams unprepared for sudden liquidity issues.

3. Customer Friction

When CRM shows one story and accounting another, customers get mixed signals — delayed invoices, repeated reminders, or errors in billing. These mistakes hurt relationships at the exact stage when loyalty is most crucial.

4. Operational Inefficiency

Teams end up re-keying data, reconciling spreadsheets, and chasing down updates. What starts as minor duplication soon eats into hours that could be spent driving sales or improving financial planning.

5. Compliance Risk

Disconnected records make it harder to demonstrate accuracy during audits or meet reporting standards. For businesses expanding into new markets, this risk can slow down opportunities.

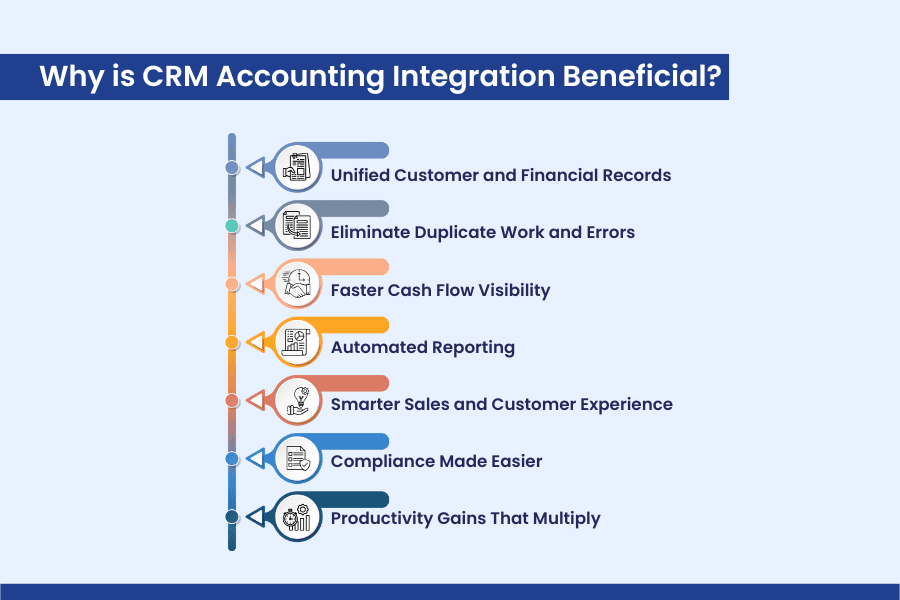

Why is CRM Accounting Integration Beneficial?

Organizations that integrate software such as CRM and accounting systems make the entire process of customer relations and finance more productive, smooth, and reliable. Let’s see how they benefit overall:

1. Unified Customer and Financial Records

When integration happens, records are centralized into a single, reliable, accessible, and manageable data source. So, a sales representative can check a client’s purchase history, or finance can verify payment terms; everyone has access to the same accurate record. This single source of truth enables smoother handoffs and faster decisions.

2. Eliminate Duplicate Work and Errors

When integration happens, many tasks that were performed twice by different persons in different systems can easily be eliminated. As the double entry not only wastes hours but also creates room for mistakes that affect revenue recognition and compliance. With CRM accounting integration, data is entered once and instantly synchronized, reducing human error and freeing teams to focus on higher-value tasks.

3. Faster Cash Flow Visibility

As soon as an invoice is raised or a payment is received, it is reflected in both the CRM and accounting systems simultaneously. This means CFOs and CEOs no longer wait until month-end reports to determine their liquidity position — they can see it daily and act more quickly.

4. Automated Reporting

Whether data is needed by the finance team, sales, or operations, once a record in the unified system has been created, these systems can generate reports instantly for any team, for any purpose. So instead of waiting for month-end reconciliations, sales will get a customer report; similarly, users can see profit by product, outstanding balances, or customer lifetime value. These insights help leaders not only understand current performance but also refine pricing, target profitable segments, and allocate resources more effectively.

5. Smarter Sales and Customer Experience

For sales teams, integration means more than just visibility. A rep can see if a customer has outstanding invoices before offering discounts. Finance teams can understand the context behind a large order without chasing sales for details. Customers benefit too — fewer billing errors, timely updates, and smoother transactions all contribute to stronger relationships at a time when loyalty is critical.

6. Compliance Made Easier

The best part of integrating accounting software with CRM is the consistency of records. When records are consistent across, then it becomes traceable and audit-ready, reducing compliance headaches.

7. Productivity Gains That Multiply

Manual reconciliations and disconnected data may work for 50 invoices a month, but not for 500. As transaction volumes increase, integrating accounting software with CRM provides the automation backbone that ensures fewer hours wasted on duplicate work. Those hours can be redirected to strategic tasks like negotiating better terms, identifying upsell opportunities, or improving financial analysis.

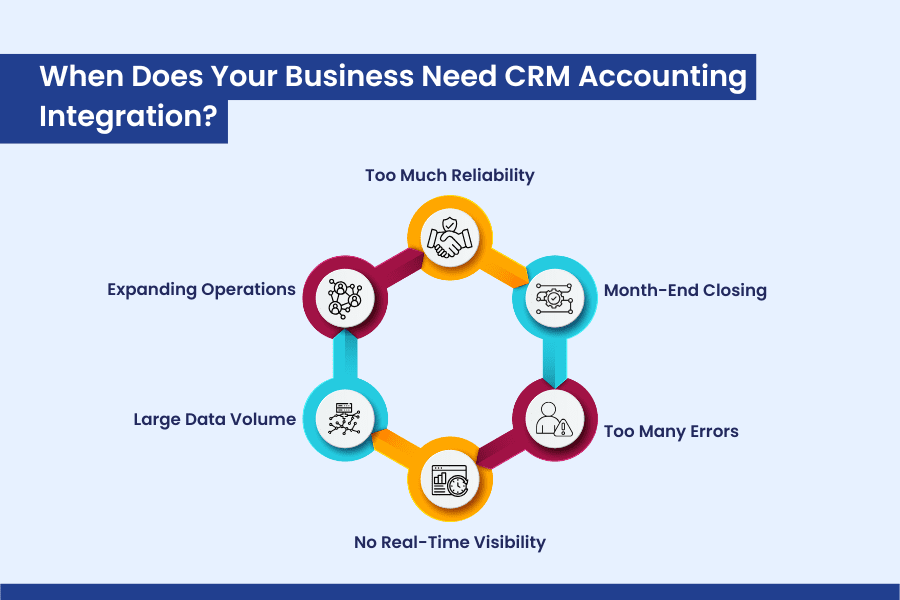

When Does Your Business Need CRM Accounting Integration?

Not every company needs integration from day one. But for fast-growing businesses, there comes a tipping point when operating with separate systems starts to hurt more than it helps. Here are the most common signs that it’s time to bring your CRM and accounting software together:

- Too Much Reliability: When your teams constantly need to export data and reconcile in Excel, then it’s a red flag.

- Month-End Closing: When finance spends days chasing down sales data just to close the books, it’s a sign that your systems aren’t aligned.

- Too Many Errors: Duplicate charges, delayed invoices, or inconsistent statements are a red flag.

- No Real-Time Visibility: If reports are always “a week behind,” integration ensures data is live, accurate, and instantly available.

- Large Data Volume: If your team is stretched thin just to keep records aligned, it’s time to automate.

- Expanding Operations: Rapid expansion or external scrutiny (from investors, auditors, or regulators) demands higher transparency and consistent records.

Choosing the CRM and Accounting Software Integration

Businesses typically need to incorporate digital resources to enhance their operations and drive growth. However, using different tools for different tasks often makes things more complicated instead of easier – this is when one should opt for integration. CRM and accounting software integration is one such step that many fast-growing businesses are opting for to achieve sustainable growth.

If you are also willing to integrate the two systems, then the key is choosing an integration that is secure, automated, and flexible enough to grow with your business. If you’re running solutions like Xero, MYOB, or QuickBooks, Soluzione’s pre-built Accounting Connector add-ons for Dynamics 365 CRM make the process seamless. These connectors enable two-way synchronization of accounts, invoices, and payments, reducing manual effort while maintaining data accuracy across platforms.

If you are looking to integrate Dynamics 365 CRM with accounting systems or want to know more about our productivity booster add-ons, then let’s get in touch. Soluzione can support you in growing without restriction with a strategic investment.

Read More: https://www.solzit.com/blog/

Frequently Asked Questions

Does CRM-accounting integration offer better visibility into customer financial data?

Yes, every user, whether from the sales team or finance, can gain complete visibility of, for example, a customer’s payment history, outstanding invoices, or credit status directly within the CRM. They not only offer better visibility but also help make crucial decisions.

What business processes are streamlined through CRM–accounting integration?

Plenty—and they're the kinds of process improvements that pay off more than you’d expect:

- Invoicing and payment reminders become automatic—no more chasing finance.

- Deal handoffs flow smoothly—sales, finance, and operations see the same updates.

- Forecasting and reporting are real-time, not month-end clumps of data.

- Dispute resolution or credit checks happen faster because data lives in one place.

Are there any risks or limitations of integrating CRM and accounting systems?

Yes, there are risks or limitations in integration, but those differ from one software to another. But commonly it includes:

- Setup effort: Poorly mapped fields or mismatched terminology can create messy data if you push integration live without preparation.

- Permissions governance: You need to manage who sees what—finance data is sensitive, and a blanket sync can expose too much.

- Version mismatches: Some integrations work better with cloud-only tools; desktop legacy systems may need middleware or a custom setup.

- Overautomation risks: Reconcile regularly—you don’t want a sync error cascading across both systems.

That said, with careful planning (and ideally with a connector like ours built for Dynamics 365 CRM), these risks are manageable and far outweighed by the productivity gains.

What ROI can businesses expect from CRM-accounting integration over time?

While every business is different, research provides a strong benchmark: one case study observed a 223% annual ROI with payback in just six months by utilizing a CRM-ERP integration. Meanwhile, Microsoft‑led implementation for a company called Kelly Roofing showed a solid 4.8× ROI from unified CRM and accounting systems.